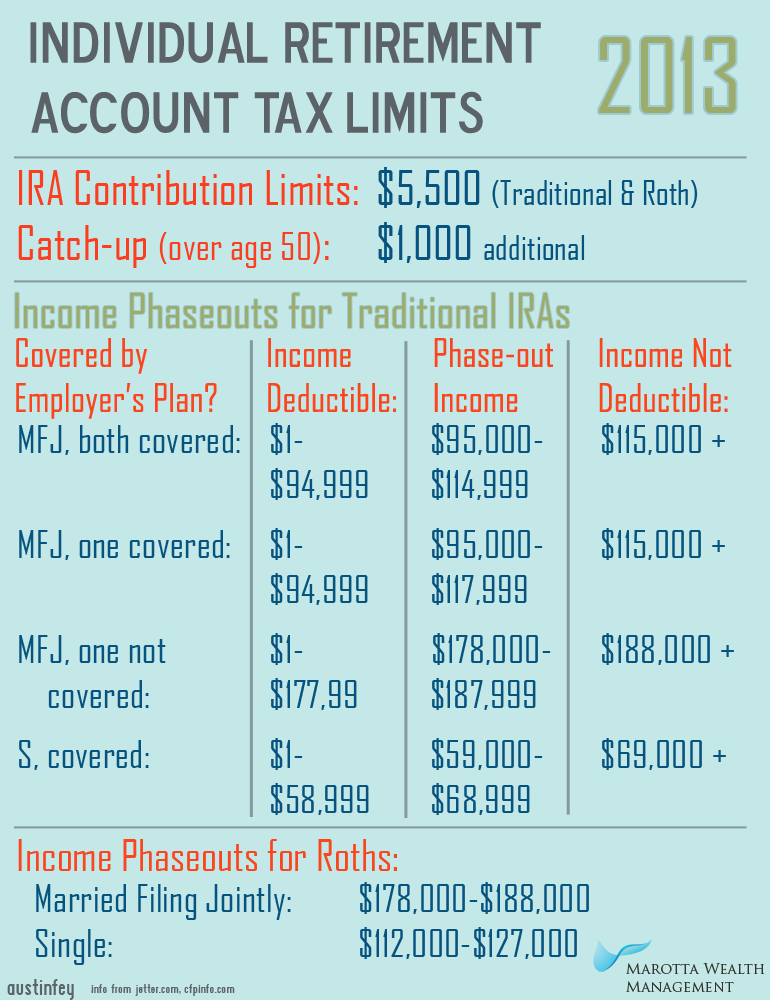

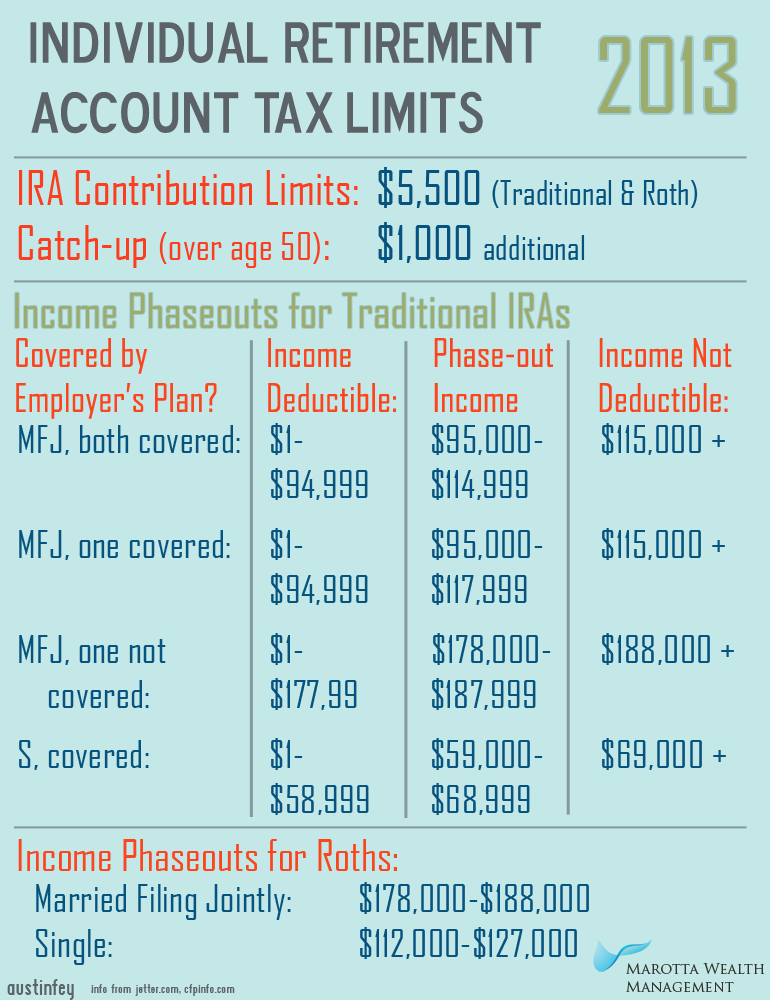

Under the existing Roth IRA rules for , you could contribute $5, to your Roth IRA and your spouse could contribute $6, to his or her Roth IRA. As a family, that means you'd be sheltering $12, in new money in your Roth IRAs, allowing you to enjoy a lot of advantages in compounding the stocks, bonds, mutual funds, real estate, or other . It’s too late to contribute to a Roth IRA for Even if you file an extension, the deadline for contributions was April 15, But if you need to check on what the income and contribution limits were, we have you covered. Roth IRA Contribution Limits. For , your individual Roth IRA contribution limit varies according to: Your tax filing status; Your income level.

Generally, it's the taxpayer's adjusted gross income calculated without certain deductions and exclusions. Don't make the mistake of confusing the two. Congress has limited who can contribute to a Roth IRA based upon income. Take the next step. A Roth can be switched back to a traditional IRA account, or re characterized.

Single roth ira income limits 2014 -

Definitely research before taking the leap! Susan, your contributions can remain in the Traditional IRA, however, they will not count as a tax deduction for this year. Thank you for addressing my second question. An IRA individual retirement account is your personal savings plan for retirement, offering tax advantages and growth that compounds over time. In particular, it does not apply to anything already taxed!

Single Roth Ira Income Limits 2014. Roth IRA Contribution Limits | Charles Schwab

Although an eligible IRA distribution received on or after Jan. You may be able to contribute to a Roth IRA for yourself or

une rencontre allocinГ© spouse if you have earned income within or below the following thresholds. These responses single roth ira income limits 2014 not provided or commissioned by the bank advertiser. So his staff limited deductible IRAs to people with very low income, and made Roth IRAs initially with income limitations available to others. Pages containing links to subscription-only content Pages with citations lacking titles Pages with citations having bare URLs Articles needing additional references from February All articles needing additional references All Single roth ira income limits 2014 articles needing clarification Wikipedia articles needing clarification from March The lower number represents the point at which the taxpayer is no longer allowed to contribute the maximum yearly contribution.

-

-

-